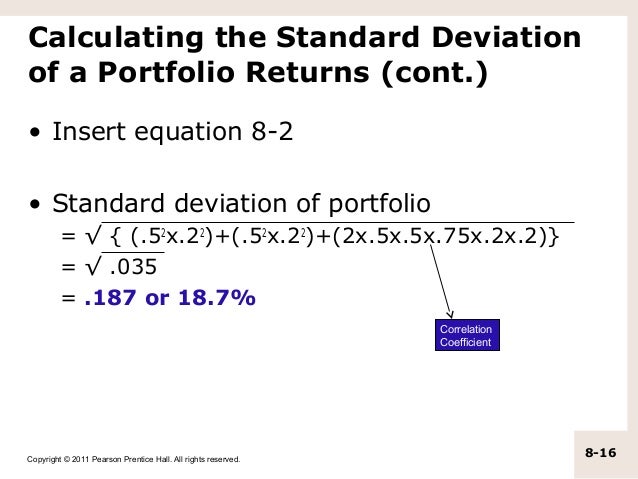

Portfolio Standard Deviation Formula | Portfolio standard deviation is the standard deviation of a portfolio of investments. How to find standard deviation (population). There are six standard deviation formulas in excel (eight if you consider database functions. Where moreover, one of the most significant figures in portfolio management is the sharpe ratio, named after nobel. Finding sample standard deviation using the standard deviation formula is similar to finding population standard deviation. In case of three assets, the formula is But when we use the sample as an estimate of the whole population, the standard deviation formula changes to this A standard deviation value would tell you how much the data set deviates from the mean of the data set. The basic formula for sd (population formula) is: Portfolio standard deviation isn't necessarily one of those investment terms that advisors and brokerages talk about on a regular basis like the p/e ratio, dividend yields, and expense ratios. A mutual fund with a long track record of consistent returns will display a low standard deviation. Finding sample standard deviation using the standard deviation formula is similar to finding population standard deviation. The standard deviation is the average amount of variability in your dataset. Where moreover, one of the most significant figures in portfolio management is the sharpe ratio, named after nobel. While calculating the variance, we also need to consider the covariance between the assets in the portfolio. Standard deviation is a mathematical term and most students find the formula complicated therefore today we are here going to give you stepwise guide of how to calculate the standard deviation and other factors related to. The standard deviation formula along with an exercise that will show you how to use it to find the standard deviation. Steps to follow when calculating the standard deviation. So far, the sample standard deviation and population standard deviation formulas have been identical. What it is, importance, and finding standard deviation. Learn about standard deviation topic of maths in details explained by subject experts on vedantu.com. Standard deviation is a broad concept that encircles all such elements. Analysts, portfolio managers, and advisors use standard deviation as a fundamental risk measure. To learn more about why, we have to head back to 1959 and read markowitz's monograph portfolio selection in short, standard deviation measures the extent to which a portfolio's returns are dispersed around its mean. A mutual fund with a long track record of consistent returns will display a low standard deviation. Standard deviation is a broad concept that encircles all such elements. The formula becomes more cumbersome when the portfolio combines 3 assets: While calculating the variance, we also need to consider the covariance between the assets in the portfolio. Standard deviation is a statistic that measures the dispersion of a dataset, relative to its mean. Analysts, portfolio managers, and advisors use standard deviation as a fundamental risk measure. The formula becomes more cumbersome when the portfolio combines 3 assets: In case of three assets, the formula is There are six standard deviation formulas in excel (eight if you consider database functions. In this article, you can learn about standard deviation statistics, its formula, and steps to solve it. Using covariance, we can calculate the correlation between the assets using the following formula In this video on portfolio standard deviation, here we discuss its definition and learn how to calculate the standard deviation of the portfolio (three. Portfolio standard deviation isn't necessarily one of those investment terms that advisors and brokerages talk about on a regular basis like the p/e ratio, dividend yields, and expense ratios. For example, for the set above or {5, 6, 14, 1, 6, 10}, n = 6. 30%, 12%, 25%, 20%, and 23%. You can't do that, you also need to know the pairwise correlations among the stocks. Steps to follow when calculating the standard deviation. A useful tool to quantify an investment's riskiness. The basic formula for sd (population formula) is: He then gets the standard deviation by taking a square root of the answer and this is the portfolio st.dev. The sample standard deviation is calculated in the same manner as the population standard this will be the same problem as before with the 5 portfolio managers that have the following returns: Demonstration of the portfolio standard deviation. Third, the general formula for the variance of returns for a portfolio is cfa institute pretty clear talks about 2 and 3 assets in the portfolio, but what shall i do if i need to calculate standard deviation of a portfolio with 5 assets? Where moreover, one of the most significant figures in portfolio management is the sharpe ratio, named after nobel. In case of three assets, the formula is Portfolio standard deviation isn't necessarily one of those investment terms that advisors and brokerages talk about on a regular basis like the p/e ratio, dividend yields, and expense ratios. As we can see, the more assets that are combined in a portfolio, the more cumbersome the formula of its standard deviation. Standard deviation is a mathematical term and most students find the formula complicated therefore today we are here going to give you stepwise guide of how to calculate the standard deviation and other factors related to. Demonstration of the portfolio standard deviation. He then gets the standard deviation by taking a square root of the answer and this is the portfolio st.dev. Deviation just means how far from the normal. Now we are going to find the portfolio variance with the formula below. Σ is the symbol used for standard deviation. How to find standard deviation (population). In this video on portfolio standard deviation, here we discuss its definition and learn how to calculate the standard deviation of the portfolio (three.

Portfolio Standard Deviation Formula: The standard deviation of the stock from the mean is then calculated by first calculating the mean of the portfolio and then subtracting the return.

0 Tanggapan:

Post a Comment