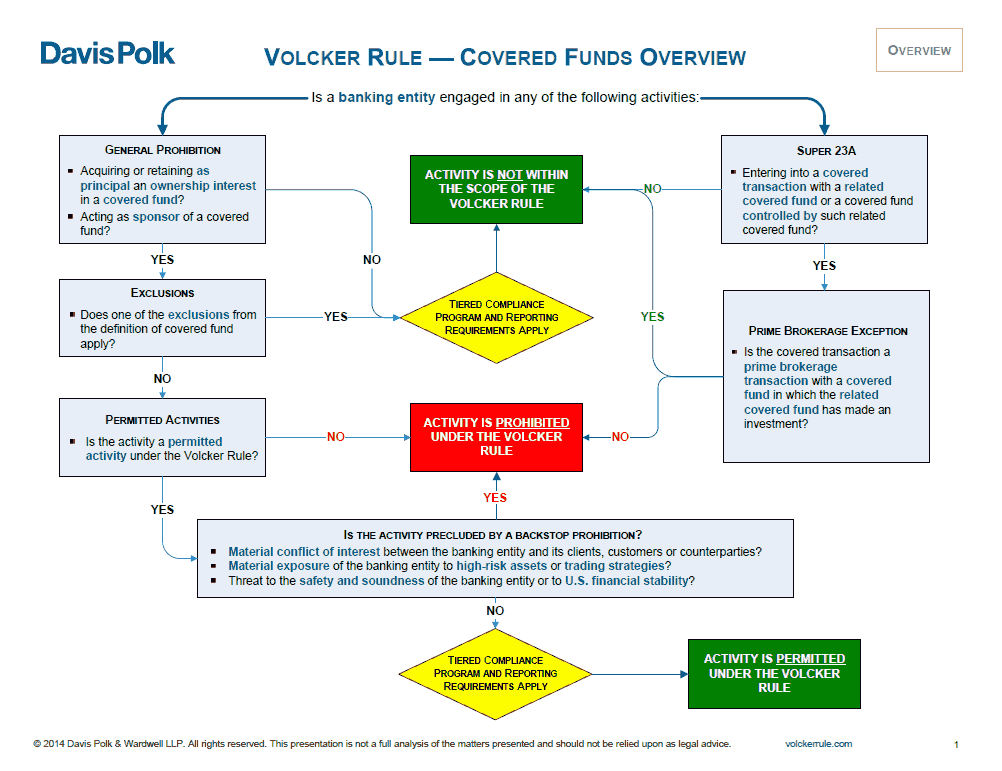

Volcker Rule Covered Fund | The final rule excludes from the definition of covered fund a registered investment company and business development company, including an answer: Volcker rule regulators make changes to covered fund rules. There's plenty to celebrate, but what could go wrong? Here are more ways it protects you. The regulation was named after former fed chairman paul under the proposed changes announced thursday, the fed plans on shrinking the covered funds that face volcker rule restrictions. Learn about the volcker rule with cfa institute. This webpage includes information on the rulemakings to implement the volcker rule, as well as related statements and other announcements. The rule was originally proposed by american economist and former united. Последние твиты от volcker rule news (@volcker_rule). (ii) is a commodity pool whose operator relies on cftc rule 4.7 (and certain similar pools); The volcker rule is a federal regulation that generally prohibits banks from conducting certain investment activities with their own accounts and limits their dealings with hedge funds and private equity funds, also called covered funds. This webpage will allow users to: They do not significantly alter the covered funds definition, which determines which funds fall under the volcker rule's restrictions on hedge fund and. Review the volcker rule and the related provisions that specify the prohibitions and restrictions of fdic supervised depository institutions. The rule was originally proposed by american economist and former united. Or (iii) a foreign fund that either relies on section 3(c). While the proposal included certain limited proposed revisions to the volcker rule's covered fund provisions, it also sought comments on other aspects of the covered fund provisions beyond those changes for which specific rule text was proposed. What is the volcker 1. This webpage includes information on the rulemakings to implement the volcker rule, as well as related statements and other announcements. The rule has turned out to be so complex that it required 21 sets of frequently asked questions, says fdic chairman jelena mcwilliams. Why does volcker cover goldman sachs and morgan stanley? Последние твиты от volcker rule news (@volcker_rule). Revises the exclusions from the definition of covered fund for foreign public funds, loan securitizations, public welfare investments, and small business investment companies Review the volcker rule and the related provisions that specify the prohibitions and restrictions of fdic supervised depository institutions. A covered fund under the volcker rule is an entity that (i) relies on section 3(c)(1) or 3(c)(7) of the investment company act; Volcker rule regulators make changes to covered fund rules. Or (iii) a foreign fund that either relies on section 3(c). What is the volcker rule? Four years later, regulators issued a final rule, based on volcker's proposal. Here are more ways it protects you. The final rule excludes from the definition of covered fund a registered investment company and business development company, including an answer: The volcker rule defines a covered fund as an issuer that would be an investment company as defined in the investment company act of 1940 but for section 3(c)(1) or 3(c)(7) of that act, or such similar funds as the agencies by rule determine. The rule was originally proposed by american economist and former united. Last year, the financial services regulators responsible for the volcker rule regulations (the federal reserve board, the securities and exchange commission, the office of the (see the new york law journal, sept. The volcker rule could potentially apply to the global structure of a foreign bank with us branches or any business of foreign banks with us counterparties. The volcker rule is a federal regulation that generally prohibits banks from conducting certain investment activities with their own accounts and limits their dealings with hedge funds and private equity funds, also called covered funds. Revises the exclusions from the definition of covered fund for foreign public funds, loan securitizations, public welfare investments, and small business investment companies This webpage will allow users to: Volcker rule critics have also claimed that the volcker restrictions would hamper bank lending, but again, the data have shown the opposite to be true. (ii) is a commodity pool whose operator relies on cftc rule 4.7 (and certain similar pools); There's plenty to celebrate, but what could go wrong? What is the volcker 1. (ii) is a commodity pool whose operator relies on cftc rule 4.7 (and certain similar pools); Последние твиты от volcker rule news (@volcker_rule). Four years later, regulators issued a final rule, based on volcker's proposal. This webpage will allow users to: Or (iii) a foreign fund that either relies on section 3(c). (ii) is a commodity pool whose operator relies on cftc rule 4.7 (and certain similar pools); Review the volcker rule and the related provisions that specify the prohibitions and restrictions of fdic supervised depository institutions. A covered fund under the volcker rule is an entity that (i) relies on section 3(c)(1) or 3(c)(7) of the investment company act; The final rule excludes from the definition of covered fund a registered investment company and business development company, including an answer: The rule was originally proposed by american economist and former united. The volcker rule defines a covered fund as an issuer that would be an investment company as defined in the investment company act of 1940 but for section 3(c)(1) or 3(c)(7) of that act, or such similar funds as the agencies by rule determine. Volcker rule critics have also claimed that the volcker restrictions would hamper bank lending, but again, the data have shown the opposite to be true. Collectively, the changes to the volcker rule regulations just adopted by the agencies will result in a meaningful lessening of the. The volcker rule could potentially apply to the global structure of a foreign bank with us branches or any business of foreign banks with us counterparties. Covered fund activities and investments. There's plenty to celebrate, but what could go wrong? Last year, the financial services regulators responsible for the volcker rule regulations (the federal reserve board, the securities and exchange commission, the office of the (see the new york law journal, sept.

Volcker Rule Covered Fund: Review the volcker rule and the related provisions that specify the prohibitions and restrictions of fdic supervised depository institutions.

Source: Volcker Rule Covered Fund

0 Tanggapan:

Post a Comment